Finance and Leasing

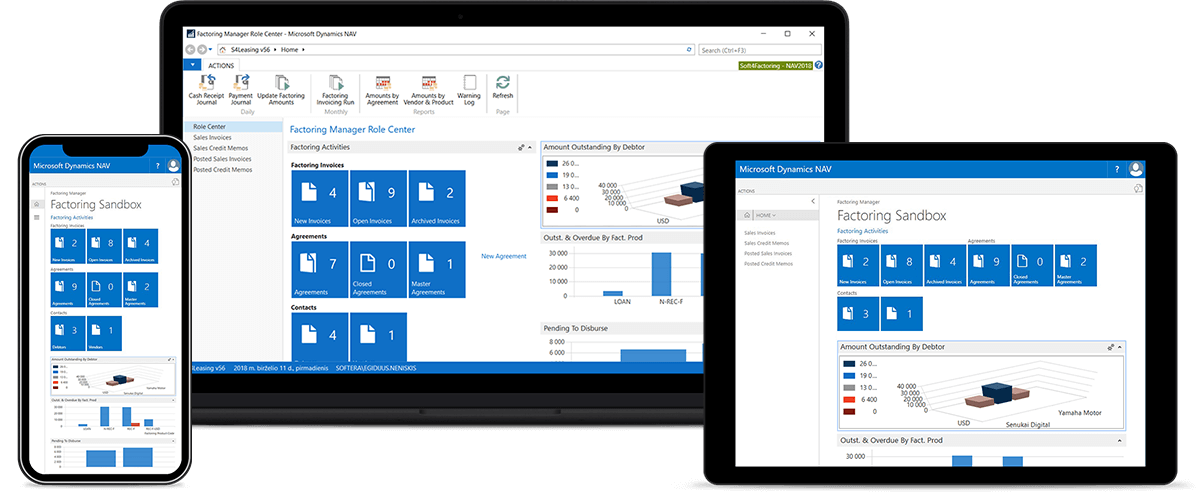

Sci-Net is proud partners of Soft4Leasing. Soft4Leasing is a tailored solution for lending and asset finance companies looking to obtain operational excellence, reduce risks, support compliance, and promote growth.

Based on Microsoft Dynamics platform, you can enjoy all the advantages of flexible leasing & rental management system with a comprehensive business management solution that helps your people work faster and smarter.

Built within Microsoft Dynamics

Soft4Leasing has been validated by an independent UK actuarial firm and complies with IFRS16 and GAAP standards

Supports finance (capital) lease, operating lease, hire purchase, and thereby brings benefits to the leasing industry.

Soft4Leasing is an all-in-one leasing and finance solution which will enable you to easily manage the entire leasing process — from a lease quote through to a whole contract to reporting. Lease processes are mapped directly to nominal accounts. There is no need for manual accounting for leases. All lease transactions, from contract activation to contract termination are automatically posted to nominated nominal accounts.

It also enables businesses to automate operations, manage and track multiple assets in a single lease and handles repossessions and returns. It integrates the work of collection agents, repossession agents, equipment resellers, and dealers.