As you will likely know on 01/01/2021 the UK will leave the EU VAT regime, Single Market & Customs union as the Brexit Transition period comes to an end. Please find some below useful information to help your business with the upcoming changes.

How will Brexit affect your Business?

Some of the key changes to note are below.

• The ending of Zero-rated B2b intra-community supplies; all movements will become imports or exports, subject to UK or EU import VAT.

• The UK will introduce a postponed accounting import VAT deferral scheme, so no cash VAT payment must be made by business importers to UK customs. However, many EU countries do not offer the same scheme for UK businesses importing their goods.

• Distance Selling Thresholds for UK e-commerce sellers of goods to EU consumers will be removed. Goods will now be subject to import VAT, and UK sellers will have to consider VAT registering in Europe immediately. Similarly, EU E-Commerce sellers may now need to register immediately for UK VAT if they have been selling to UK customers under the £70,000 threshold.

• Any UK Business with a foreign VAT Registration in the EU may now face the obligation to appoint a special VAT Fiscal representative. This applies in 19 of the 27 EU States. These agents hold direct liability for any unpaid VAT, and therefore require cash deposits or bank guarantees in exchange.

• There will be limited changes on the VAT on services for B2B transactions after the UK leaves the EU VAT regime. The reverse chare will still apply.

• Intrastat reporting after Brexit will still be required for 2021 for arrivals / imports into GB from the EU. But they will not be required for dispatches / exports to the EU.

As every business is different it is important that you completely understand the requirements for your business from 01/01/2021. Full guidance can be found on the Gov.uk Brexit Transition site or alternatively you could speak to a specialist for advice.

Do we need to update our system?

Microsoft have advised that they do not foresee any system changes and that the changes made can be managed through configuration changes.

So what configuration changes do we need to make?

As every business will be affected in different ways depending on the type of trade, they do with the EU there is no one size fits all approach with this, but most companies affected will need to consider the following changes.

• Review your current VAT Business Posting Groups and does this allow you to manage the requirements. For example, if you are selling in a B2C environment and are registering for VAT in different countries then you may want to have a set up where the VAT Business Posting Groups equals the Country Code for each country you are registered for VAT in.

• You may need to set up new VAT Business Posting Groups to be used for imports.

• Add the new VAT Business Posting Groups to the VAT Posting Set-up.

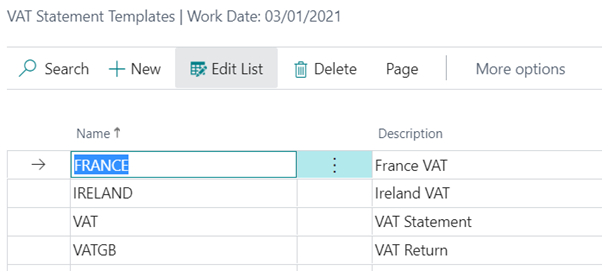

• Review your current VAT Statement used for UK submissions.

• If you are registering for VAT in any other countries, you will need to do the following for each country you are registering in.

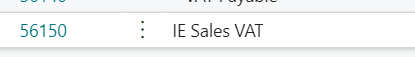

o Update VAT Posting set-up with correct VAT percentages for each country using the new VAT Business Posting Group.

o Create a new VAT Statement for each country.

• Do you need to have any new General Ledger Account Codes set-up to for postponed VAT or VAT liabilities in other countries etc.

• Amend set-up on existing Customers & Vendors outside the UK (This should not be done until 01/01/2021).

• Consider any templates you may have set-up in the system that may be used to create new Customers or Vendors.

For our Sage Customers

Sage put together a dedicated Brexit Hub to help customers understand how the changes could affect UK business, and what you might need to do.

What can Sci-Net do to help you?

Sci-Net will be able to support you through this transition by discussing the different options you have & best practices for re-configuring the VAT module to be compliant from 01/01/2021.

Sci-Net will also be able to assist with the configuration if required.

What Sci-Net cannot do to help you?

Sci-Net will not be able to advise on how the changes affect your business specifically as we are not Tax & VAT specialists.

Sci-Net will not be able to do the configuration for you. If this is something you cannot do internally then we will manage this via a change request for some additional training or consultancy work. Customers, please go through the normal support channels where someone will be able to assist you.